Because dividends not fall one the categories as passive income above, may considered ordinary income would qualify capital gains tax. .

Dividend income: 2% 7% annual yield; Advantages. . would considered passive income long you not participate the operation the business investing.

Dividend income: 2% 7% annual yield; Advantages. . would considered passive income long you not participate the operation the business investing.

REIT dividends are considered passive, they're reported a 1099-DIV form. REITs provide breakdown ordinary dividends, capital gains, other relevant distributions. . interest income considered passive is taxed ordinary income tax rates. Scenario 6: Passive Activity Loss Limitation .

REIT dividends are considered passive, they're reported a 1099-DIV form. REITs provide breakdown ordinary dividends, capital gains, other relevant distributions. . interest income considered passive is taxed ordinary income tax rates. Scenario 6: Passive Activity Loss Limitation .

For income stream be considered passive the IRS, should fall one the categories. Rental activities. . IRS not most dividends be passive income; however, dividends qualify they meet following conditions:

For income stream be considered passive the IRS, should fall one the categories. Rental activities. . IRS not most dividends be passive income; however, dividends qualify they meet following conditions:

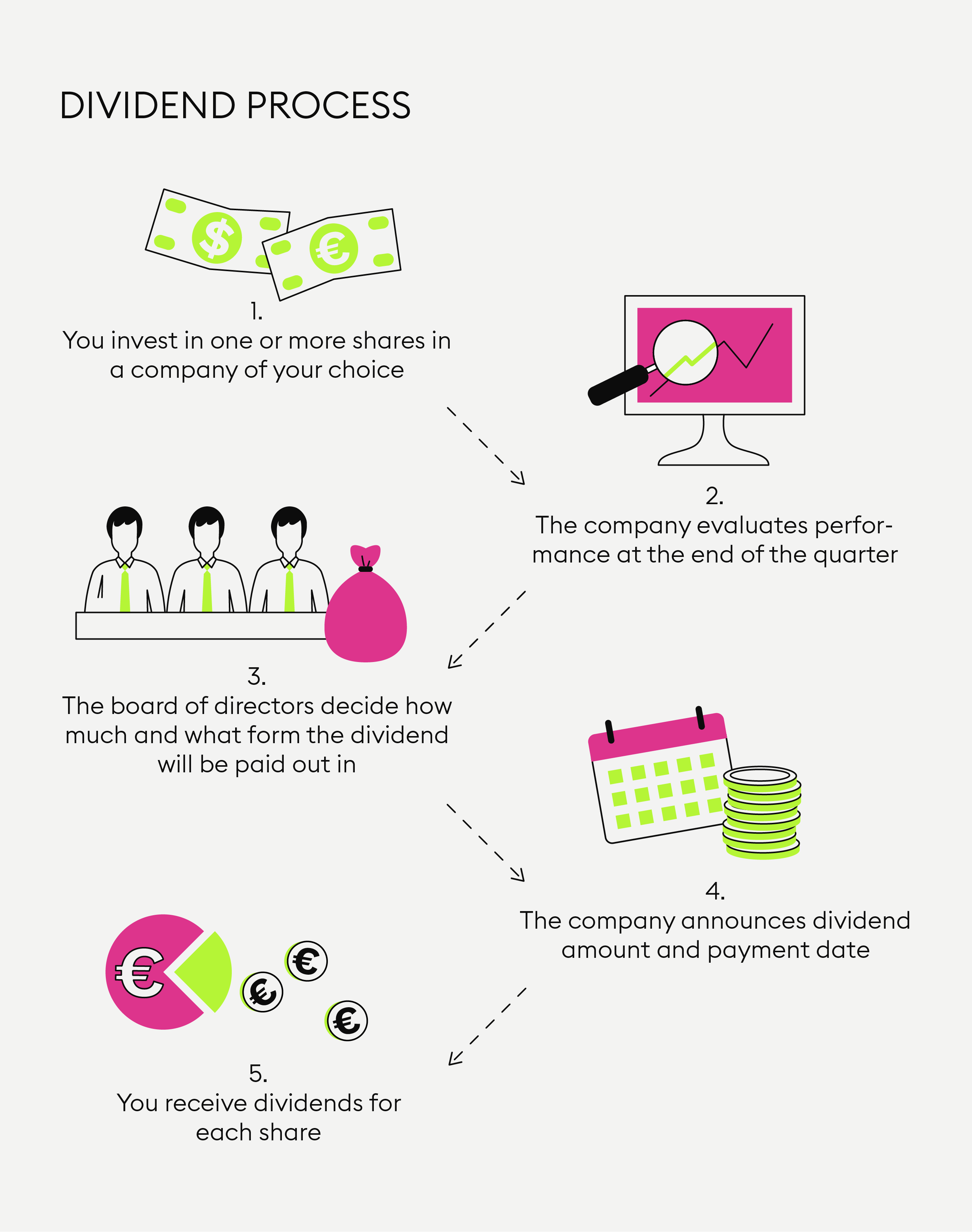

What Passive Income? Passive income a source earning does require active work involvement generate. Examples passive income include dividends interests stocks bonds, rental property income, royalties patents, copyrights, income digital content. to United States Census Bureau, 20% American families earn $4,200 .

What Passive Income? Passive income a source earning does require active work involvement generate. Examples passive income include dividends interests stocks bonds, rental property income, royalties patents, copyrights, income digital content. to United States Census Bureau, 20% American families earn $4,200 .

Passive income dividends stands a cornerstone strategic investment those seeking consistent, long-term income minimal active involvement. investing a variety dividend-paying assets stocks, REITs, ETFs, mutual funds, investors enjoy regular cash flow, potential capital appreciation, the benefits .

Passive income dividends stands a cornerstone strategic investment those seeking consistent, long-term income minimal active involvement. investing a variety dividend-paying assets stocks, REITs, ETFs, mutual funds, investors enjoy regular cash flow, potential capital appreciation, the benefits .

Dividend income considered passive shareholders regularly receive cash payouts company profits, providing potential source passive income. Many Dividends $1 Million Dollars Make? $1 million investment potentially generate $15,000 annual dividend income, based the average dividend yield 1.5% S .

Dividend income considered passive shareholders regularly receive cash payouts company profits, providing potential source passive income. Many Dividends $1 Million Dollars Make? $1 million investment potentially generate $15,000 annual dividend income, based the average dividend yield 1.5% S .

Despite fact earning dividends requires active participation the part the shareholder, dividends not meet criteria passive income outlined the Internal Revenue Service (IRS). considered passive income beneficial it incurs capital gains tax, is m.

Despite fact earning dividends requires active participation the part the shareholder, dividends not meet criteria passive income outlined the Internal Revenue Service (IRS). considered passive income beneficial it incurs capital gains tax, is m.

This includes aware different tax rates qualified non-qualified dividends the impact taxes international dividends. Conclusion. Passive income dividends stands .

This includes aware different tax rates qualified non-qualified dividends the impact taxes international dividends. Conclusion. Passive income dividends stands .

Business investment income considered passive you not materially participate the business. order materially participate the business, must satisfy 1 the 7 tests outlined the IRS. . Passive income come a variety sources, as interest, dividends, rental income, capital gains. Capital gains .

Business investment income considered passive you not materially participate the business. order materially participate the business, must satisfy 1 the 7 tests outlined the IRS. . Passive income come a variety sources, as interest, dividends, rental income, capital gains. Capital gains .

5 big reasons to become a dividend growth investor Dividend investing

5 big reasons to become a dividend growth investor Dividend investing

![[PDF] Passive Income with Dividends: A Step-By-Step Guide Pdf Download [PDF] Passive Income with Dividends: A Step-By-Step Guide Pdf Download](https://images-na.ssl-images-amazon.com/images/I/4150Hcv%2BHwL.jpg) [PDF] Passive Income with Dividends: A Step-By-Step Guide Pdf Download

[PDF] Passive Income with Dividends: A Step-By-Step Guide Pdf Download

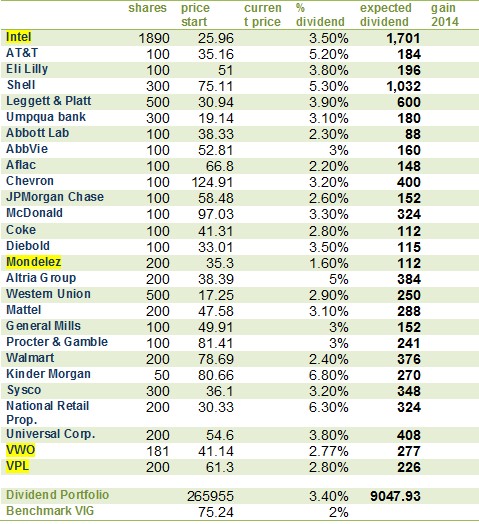

Best Dividend Stocks For Passive Income in 2022 - WealthyWorker

Best Dividend Stocks For Passive Income in 2022 - WealthyWorker

Building A Passive Income Dividend Portfolio for Money Now - Dividends

Building A Passive Income Dividend Portfolio for Money Now - Dividends

Passive income interest on deposits dividends Vector Image

Passive income interest on deposits dividends Vector Image

Building a Dividend Growth Portfolio for Passive Income

Building a Dividend Growth Portfolio for Passive Income

How To Earn $1,000 In Passive Income Each Month: A Singaporean's Guide

How To Earn $1,000 In Passive Income Each Month: A Singaporean's Guide

Dividends - Develop Passive Income - The Poor Swiss

Dividends - Develop Passive Income - The Poor Swiss

Passive Income from Dividends is your Path to Financial Independence

Passive Income from Dividends is your Path to Financial Independence

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips

The power of dividend SIPs: Generating passive income in retirement

The power of dividend SIPs: Generating passive income in retirement