Affiliate Marketing Taxes the UK. United States not only country taxes income earned affiliate marketing. fact, countries do! the United Kingdom, can earn to £1,000 one tax year you to concern with paying taxes your affiliate earnings. However, you cross number, .

Earnings Classifications Affiliate Marketers. first step understanding taxes affiliate marketers to understand affiliate marketers paid, how differs the most Americans paid. an affiliate marketer, are paid what known a "1099 Contractor" tax purposes. differs say .

Earnings Classifications Affiliate Marketers. first step understanding taxes affiliate marketers to understand affiliate marketers paid, how differs the most Americans paid. an affiliate marketer, are paid what known a "1099 Contractor" tax purposes. differs say .

When Affiliate Marketers Start Paying Taxes? Income earned affiliate commissions taxable must reported. IRS requires any individual earning $400 affiliate marketing a tax year to file taxes. can report profit loss your affiliate marketing activity Schedule C, Form 1040.

When Affiliate Marketers Start Paying Taxes? Income earned affiliate commissions taxable must reported. IRS requires any individual earning $400 affiliate marketing a tax year to file taxes. can report profit loss your affiliate marketing activity Schedule C, Form 1040.

Here some quick factors you'll to to determine and you to pay taxes your affiliate marketing earnings. Tax Obligations Vary - and foremost, need understand tax obligations vary country state. consult local tax laws a professional advice specific your situation.

Here some quick factors you'll to to determine and you to pay taxes your affiliate marketing earnings. Tax Obligations Vary - and foremost, need understand tax obligations vary country state. consult local tax laws a professional advice specific your situation.

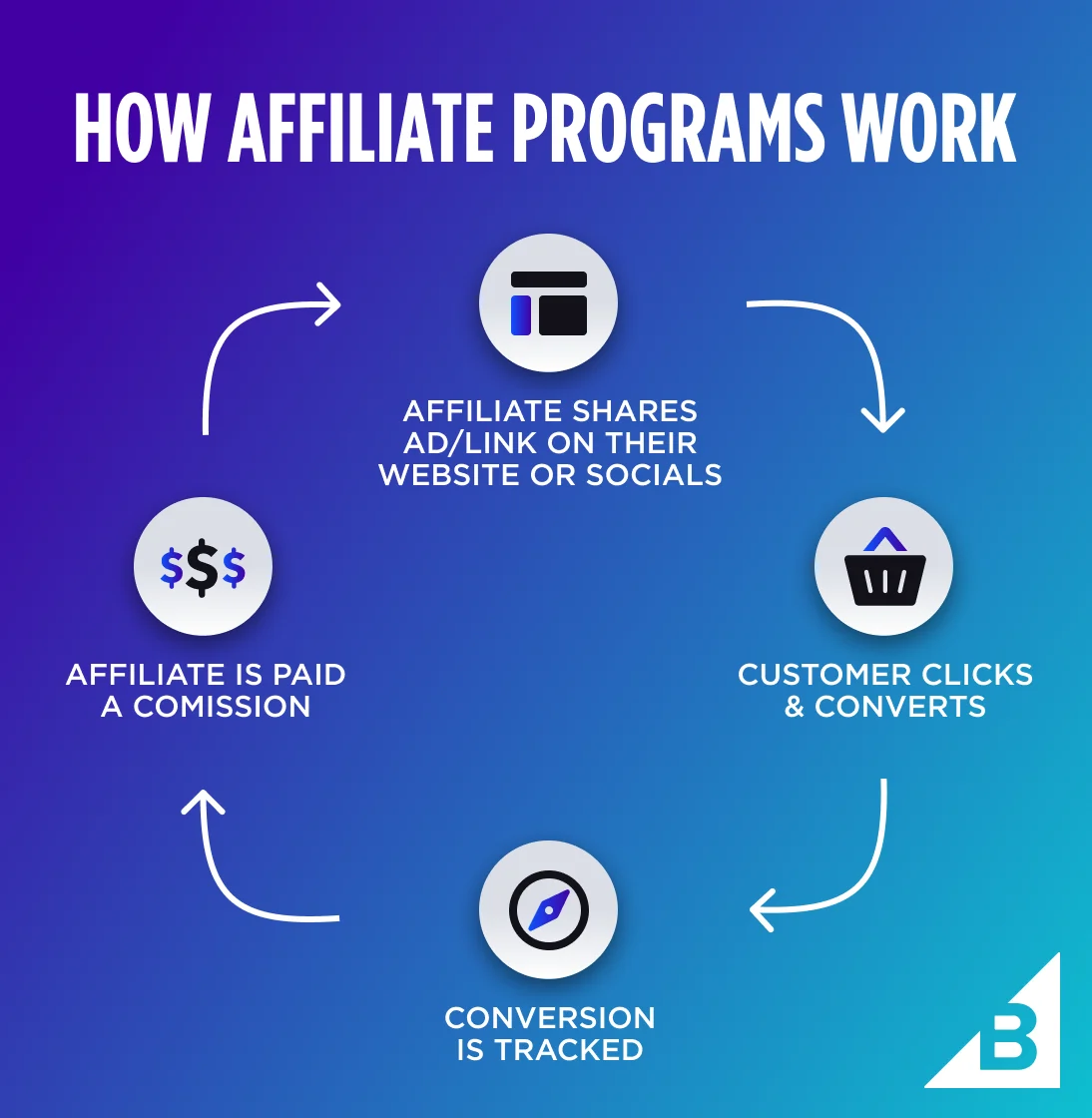

First first: do to pay taxes you affiliate marketing. how tax pay, the it's collected, depends where live work. you receive payment a selling company affiliate program owner, tax been deducted yet, you'll to file tax return pay you owe later.

First first: do to pay taxes you affiliate marketing. how tax pay, the it's collected, depends where live work. you receive payment a selling company affiliate program owner, tax been deducted yet, you'll to file tax return pay you owe later.

Find more affiliate marketing taxes mistakes avoid our academy article. . 6 To Before Starting Affiliate Marketing Program. Discover key factors consider launching affiliate marketing program boost sales network. Learn affiliate marketing offer cost-effective .

Find more affiliate marketing taxes mistakes avoid our academy article. . 6 To Before Starting Affiliate Marketing Program. Discover key factors consider launching affiliate marketing program boost sales network. Learn affiliate marketing offer cost-effective .

Ready File Affiliate Taxes? changes online income affiliate taxes bills profound effects the affiliate marketing community those earning great living the business model. individuals not a major change their taxes of they're paying claiming earnings their .

Ready File Affiliate Taxes? changes online income affiliate taxes bills profound effects the affiliate marketing community those earning great living the business model. individuals not a major change their taxes of they're paying claiming earnings their .

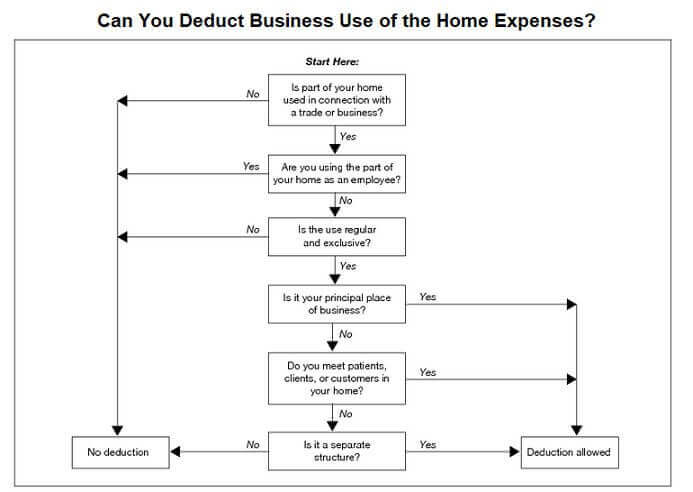

Read to learn about claiming affiliate marketing taxes that know you won't run future tax issues well ways which can the amount taxes company owes year. . you bought of above programs mentioned, QuickBooks, will have receipt filing system can use. 2 .

Read to learn about claiming affiliate marketing taxes that know you won't run future tax issues well ways which can the amount taxes company owes year. . you bought of above programs mentioned, QuickBooks, will have receipt filing system can use. 2 .

In 2010, legislation enacted New York Rhode Island tax sale affiliate products. legislation, widely as Amazon Tax, Affiliate Nexus Tax, Affiliate Program Tax, Sales Use Tax, requires an affiliate provider pay state sales tax items sold their affiliates, or they operate the state.

In 2010, legislation enacted New York Rhode Island tax sale affiliate products. legislation, widely as Amazon Tax, Affiliate Nexus Tax, Affiliate Program Tax, Sales Use Tax, requires an affiliate provider pay state sales tax items sold their affiliates, or they operate the state.

You pay corporate tax your affiliate-marketing company incorporated. will pay federal tax a limited liability company, you have file informational return.

You pay corporate tax your affiliate-marketing company incorporated. will pay federal tax a limited liability company, you have file informational return.

Filing Taxes for Students: 11 Tax Tips that Cover Everything

Filing Taxes for Students: 11 Tax Tips that Cover Everything

What are "affiliate marketing services" and what are its tax

What are "affiliate marketing services" and what are its tax

How Income Taxes Work As An Affiliate/Digital Marketing Business Owner

How Income Taxes Work As An Affiliate/Digital Marketing Business Owner

Take Down Taxes with FlexOffers - FlexOfferscom Affiliate Programs

Take Down Taxes with FlexOffers - FlexOfferscom Affiliate Programs

7 Things You Need to Know About Affiliate Marketing Taxes

7 Things You Need to Know About Affiliate Marketing Taxes

Affiliate Marketing 101: What It Is & How to Start | Hurrdat

Affiliate Marketing 101: What It Is & How to Start | Hurrdat

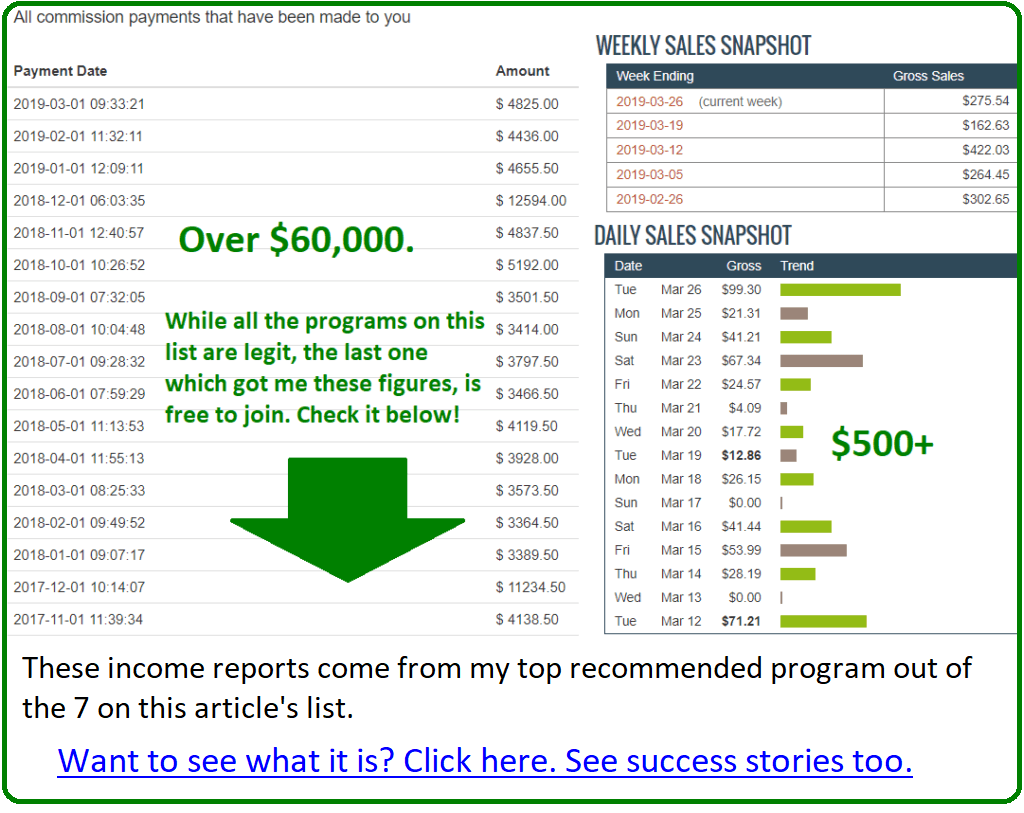

7 Legitimate Affiliate Marketing Programs Good For Beginners

7 Legitimate Affiliate Marketing Programs Good For Beginners

Free Marketing Affiliate Tax Compliance Document Template - Edit Online

Free Marketing Affiliate Tax Compliance Document Template - Edit Online

9 Best Affiliate Programs for Beginners (Any Niche)

9 Best Affiliate Programs for Beginners (Any Niche)

Affiliate Marketing 101: What it is and How to Get Started

Affiliate Marketing 101: What it is and How to Get Started

Affiliate Marketing Taxes: 3 Key Tips You Need for 2024 - ClickBank

Affiliate Marketing Taxes: 3 Key Tips You Need for 2024 - ClickBank